GameStop, Robinhood and the Millennial Drive for Return

March 4, 2021 | Caroline Vahrenkamp

Caroline Vahrenkamp and Lynne Cornelison

While the spotlight has been on the “little guy” versus the short sellers, the real story of the /WallStreetBets saga is the desire for any sort of return.

Investing

Recently, small retail investors made big news by combining forces to drive up the stock of GameStop, a struggling video game rental brick-and-mortar chain that had been targeted by hedge funds looking to short-sell the stock. While the “little guy versus Wall Street” narrative has driven coverage, I’m more interested in the why and how this happened.

In this case, the effort to buy up GameStop began in a forum or “subreddit” on Reddit, a social media forum website. This subreddit, /WallStreetBets, counts 8.2 million members and consists primarily of young millennials, based on responses to a post from Jan 30. This should not be surprising given the research we’ve presented previously.

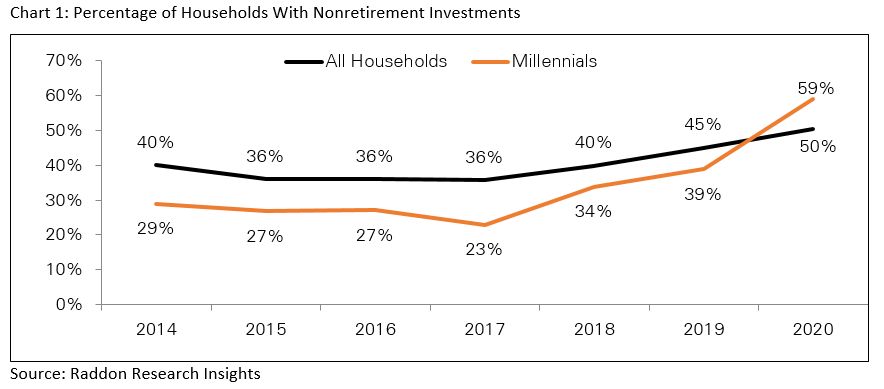

We know from recent Raddon Research Insights (Deposit Insights: Rise of the Millennial Saver) that 57 percent of millennials say they have nonretirement investments, up from just 23 percent three years ago. Millennials have found the market, even though their balances are still well below average ($158,000 for those with investments versus $250,000 for all generations).

The small investors took advantage of two technologies that have leveled the playing field: mobile investment apps and social media. Apps like Robinhood, Acorns and Wealthfront have dramatically lowered the cost of entry into the market, offering market access at much lower minimums than what traditional brokerages, advisors and investment banks have offered.

Raddon Research indicates that millennials and the early members of Gen Z are far more interested in these apps than older consumers, with 51 percent either using or being interested in using an app like Acorns or Robinhood, compared to 29 percent of the general population.

Robinhood last reported having 13 million users, more than both Schwab and E*Trade, and those users traded four times more often on average. All told, according to the European Business Review, robo-advisors control 65 percent of the wealth business in the United States.

But while the technology and low minimums allow participation, that alone would not create the concerted effort we’ve seen. For that, we look at social media, where individual investors can collaborate, share tips, trade recommendations and provide research otherwise unavailable. The maneuver to prop up GameStop, AMC, Blackberry and others came from Reddit, and other social media forums and sites could provide a similar outlet.

The Search for Return

The technology and social media do not explain why so many millennials are using investment apps to enter the market in the first place. What may be driving them is a desire for return.

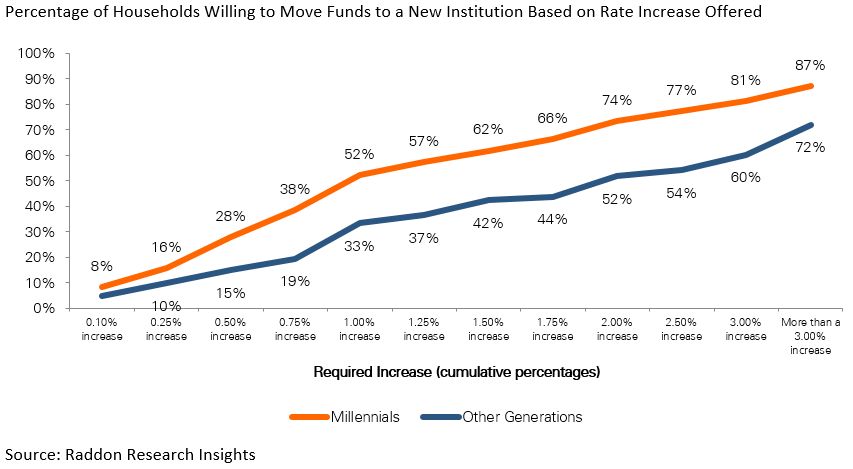

As we noted in Deposit Insights: Rise of the Millennial Saver, millennials are more rate sensitive than any other group of depositors. While this might not seem logical given their fairly low average savings balances, bear in mind that millennials have never known a high-rate environment. Unlike boomers or even Gen Xers, they are generally familiar with only the close-to-zero world the United States has enjoyed since the Great Recession. When 0.12 percent is your expectation, getting an extra 0.50 percent seems like a strong boost. For people who remember 12 percent certificates, 0.25 percent barely registers a peek.

We’ve found that 16 percent of millennials are willing to move their funds to a new institution for a 0.25 percent rate increase, compared to only 10 percent of other generations. The gap widens at a 0.75 percent increase, where 38 percent of millennials would move, twice as many as the other generations.

With rates falling in insured deposit accounts, the market represents a place to earn a return they might not get elsewhere.

Where Do Financial Institutions Fit?

While traditional banks and credit unions might look at this robo-advising revolution and wonder how they fit, there is still plenty of hope if they move swiftly.

Millennials are aware of what financial technology, products and resources their financial institution offers for investments and financial planning. Deposit Insights: Rise of the Millennial Saver shows 60 percent of millennials would consider their primary financial institution as a source for investing in stocks or mutual funds, and that 58 percent of millennials think it’s very or extremely important that their financial advisor work for their primary financial institution.

While financial advice might seem unnecessary, most millennials desire it. Forty-seven percent of millennials claim to have someone who serves as a financial advisor, compared to only 39 percent of all consumers. And when it comes to investing their funds, four in 10 millennials prefer to receive advice on where they invest the majority their funds. An additional 17 percent like to receive advice on where to invest some of their money, but they are comfortable with making their own decisions on the rest. So institutions offering advice certainly have a role to play.

How they play matters, though. Fifty-one percent of millennials feel the investment technology resources that their financial institution offers impacts their decision to use that institution, compared to 27 percent of baby boomers. Given that technical requirement, institutions might find it valuable to partner with an existing fintech or robo-advisor to offer those services.

Of course, the easier those tools and services are to use, the more likely they will be used and earn higher levels of retail investor satisfaction.

Another important piece to consider is financial education, something 65 percent of millennials say they would find valuable. Many small investors could very well lose money in this process, since the underlying company performance is unchanged despite the increased stock price. Financial institutions in an advisory role can promote resources and educational opportunities to inform investors on how much debt is too much debt, assessing the risk they would be taking on with certain investments and how to approach these factors prudently. These tools may help to protect the small investor. Financial institutions that align themselves as a partner with the investor, who can meet the investors where they are regardless of how much they can invest, can develop a longer and more sustainable relationship.

By combining strong financial planning and advisory services with the technological infrastructure, banks and credit unions can perfectly position themselves to provide both advisory services and the tools and resources for the millennial retail investor to make those decisions themselves.

Want to ask us a question?

Interested in our services?

We’re here to help.

2900 Westside Parkway

Alpharetta, GA 30004

© 2025 Fiserv, Inc., or its affiliates.